While financial market prices are in theory a public good timely and interpretable market signals are often hidden behind expensive, private paywalls.

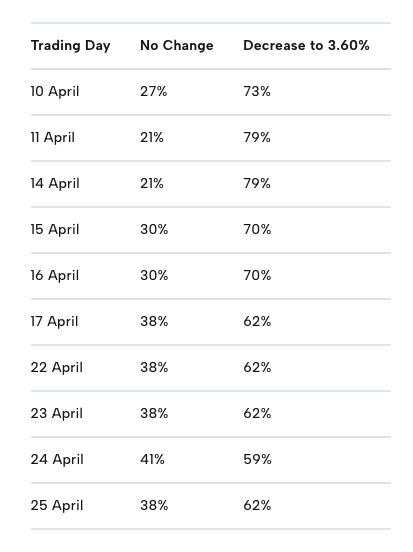

To help make this information a bit more accessible I've put together a model that turns ASX interbank futures into precise probability estimates for RBA rate moves—so you see the full likelihood of every outcome, not just the midpoint:

This data updates itself regugarly based on the ASX’s futures prices and can be accessed at:

https://igross.github.io/cash-rate-forecasts/

Readers might be used to the ASX’s own estimates of the RBA rate changes which interpret probabilities through a linear expected probability model. However these measures are misleading, especially when there is a high degree of volatility or uncertainty in the market.

For example current market pricing implies a mean fall of 28 bp at the May RBA meeting. To extrapolate this mean estimate into probabilities of various cash rate changes some assumptions are required. The ASX picks two options and calculates the likelihood that one of these two outcomes occurs. Currently the ASX page interprets this (oddly in my opinion) as a 60/40 probability between a 50bp cut or no change.

The ASX model does a decent job when the market is relatively calm and the only option on the table is a single cut or hike. But it breaks down when there are multiple options on the table or the potential for a double hike or cut - an increasingly common occurrence especially given the reduction in RBA meeting frequency!

However my model, which uses historical errors to assign probabilities to different changes in the cash rate (in combination with a linear probability model) suggests that there are currently three possible cut sizes:

50bp 14%

25bp 84%

0bp 2%

This is a time-sensitive confidence band— with standard errors shrinking the closer we get to decision day, because history shows that forecasting errors shrink as markets firm up their convictions. Using these historical errors, we recut the distribution back into the most likely buckets.

We also provide these probability estimates for longer range RBA meetings. More cuts are very likely in the short run - but we cannot rule out the possibility of hikes by the end of the year if we get quite unlucky on the inflation front.

Have a look at the fan chart, bar charts and probability lines over at igross.github.io/cash-rate-forecasts. If you have any feedback or suggestions let me know!

Big thanks to @MattCowgill whose cash rate scrapper formed the foundation for much of this code!