How will Yield Curve Control End?

With a whimper or a Bang!?

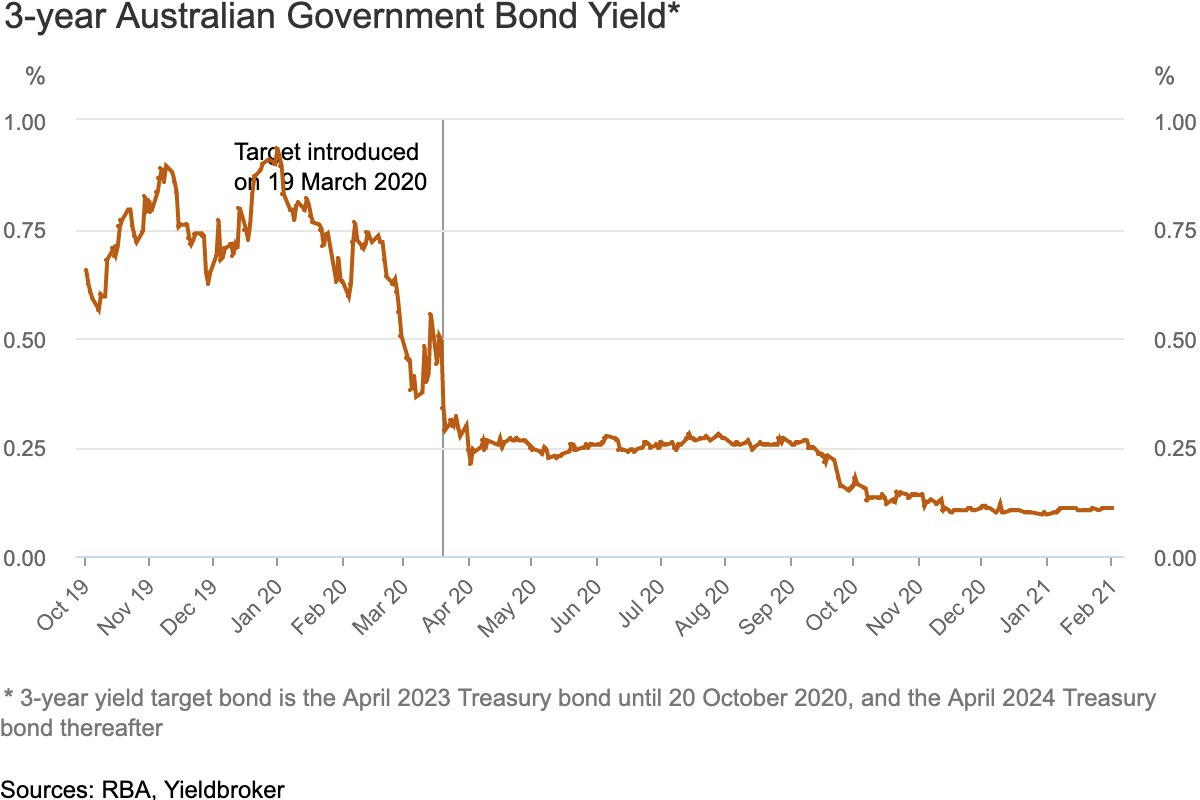

The RBA‘s program of yield curve control (YCC) was policy move almost without precedent - having only been tried before in Japan. Pegging the interest-rate on 3 year bonds close to 0 per cent helped stimulate the economy throughout 2020 saving jobs across Australia. But as the economy starts to recover this unique policy poses a problem: since no country has every stopped “controlling the yield curve” the RBA does not have a roadmap for ending the policy.

How then will Yield Curve Control end? To paraphrase TS Eliot the end will come in one of three ways: a bang, a crawl or a whimper.

BANG!

The most straightforward way the RBA’s peg my end is with a sudden overnight abandonment. On the first Tuesday of the month the RBA would simply announce that medium term bond yields were no longer being pegged and would now be freely determined by the market.

This would be similar to how the Swiss National Bank ended their peg of the Swiss Franc back in 2015. The big advantage of this instantaneous approach is that it provides a high degree of flexibility if the RBA wanted to quickly lift interest rates and by ending the peg in its entirety it eliminates any risk of a speculative attack.

However this comes with a large downside, potentially harming the RBA’s credibility. YCC implies a commitment that interest rates will be maintained at, or below, their pegged level for the duration of the policy. A sudden abandonment of YCC would break this implied commitment, thus undermining any attempt to use YCC to fight off a future recession. Because of this significant cost it is unlikely the RBA will go down this path unless inflation goes absolutely hogwild over the next couple of years. If the RBA saw inflation go north of 4% and suddenly needed to lift interest rates they may decide that the YCC was such a failure that it doesn’t matter if it’s unable to be credibly used in the future.

Crawling towards normality

The second approach to unwinding the YCC would be a controlled lift off via a crawling peg. Instead of pegging the 3 year interest rate at 0.1 per cent the RBA could slowly lift the interest rate at which bond yields are fixed until it no longer binds the market price of bonds. This would have the advantage of slowly unwinding the intervention into medium term yields and would involve significantly less disruption than an overnight abandonment. However it still may pose some risk of denting the RBA’s credibility, if not quite as badly as a sudden stop. It might also encourage speculative attacks against the peg as financial markets try to second guess when the RBA will change interest rates which would require more frequent intervention by the bank.

… or a whimper?

The final way YCC may end is by letting it slowly evaporate. Currently interest rates are fixed at 0.1 per cent for a three year horizon. Since YCC’s inception in March last year this three year window has been continually pushed out, such that it now includes the Treasury Bond line due in April 2024. Instead of keeping the peg’s horizon at a fixed 3 year term the RBA could simply announce that only bonds due in 2024 will be kept at 0.1 per cent and that over the next three years the peg will slowly be unwound, with the horizon decreasing as 2024 draws closer. Then in three years time only the overnight interest-rate will be set by the RBA AKA conventional monetary policy.

Which endgame will the RBA choose?

To a large extent this will depend on how the economy evolves over the next year. The RBA will only embrace a sudden abandonment of YCC if the economy and the rate of inflation suddenly roars back to life. Given this is unlikely to happen, option A also has a small chance of occurring.

The safest way for the RBA to end YCC whilst fully maintaining their credibility with financial markets would be option C - the slow rollback. This would allow them to gently telegraph when interest rates would start to rise without ever breaking their commitment to keep interest rates low. Whether they will be able to safely achieve this plan will depend on how quickly the economy recovers and when inflation expectations start to rise.

Of course option C requires a long lead time to be properly implemented. So it would not be surprising if the RBA announced in the first half of 2021 that YCC was coming to an end - but with a 3 year roadmap to getting there.