Something's Got to Give

Low unemployment rate, moderate inflation & a high NAIRU - Pick two!

Financial markets are certain of one thing: the RBA is all but certain to cut interest rates at its July meeting.

What remains deeply uncertain is the puzzling state of the labour-market puzzle. Over the first half of 2025, three things have been simultaneously true: the unemployment rate has held steady at 4.1 percent; inflation has decelerated sharply into the target band; and the RBA’s estimate of the full-employment (NAIRU) rate still hovers above 4.5 percent. These facts are clearly in tension, and over the next six months at least one of them will have to give.

To resolve this puzzle ether inflation will need to rebound, confirming the labour market’s strength; the labour market will soften; or the models will adapt to the new data and revise the NAIRU estimate down. Notably market economists are all in on the latter outcome. They collectively estimate the NAIRU to be around 4.25% and as low as 3.5% which is nowhere near where the models’ spread of outcomes. Hard to say what drives such outlier forecasts - but it is certainly a brave call.

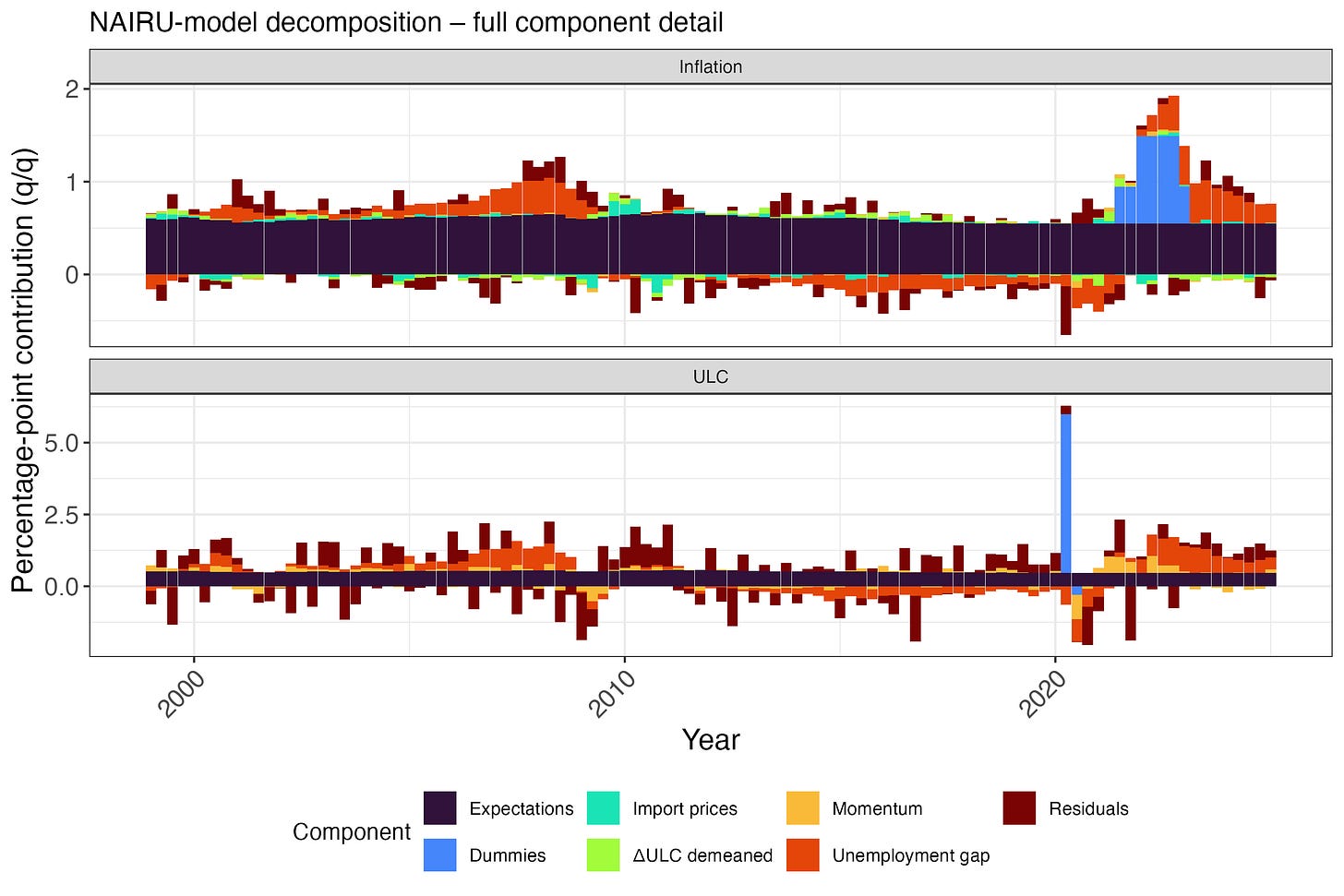

There has already been a modest downward tilt in the NAIRU over the past six months according to my model —though it was still trending up as recently as late last year. Model estimates attribute the recent inflation drop to a few one-off shocks, and they assume that won’t last if trends persist. The divergence between the data and the RBA’s unemployment forecasts is telling: the Bank keeps pencilling in higher unemployment despite the economy’s resilience. In many ways, this is a good-news story—the economy is outperforming the RBA’s pessimistic stance, reversing the pre-pandemic pattern when its wage optimism kept being dashed on the rocks of weak aggregate demand.

Ultimately, how this puzzle resolves will shape the number of rate cuts the RBA can deliver through 2025. One more cut would bring us close to the Bank’s previously estimated neutral rate. But if the NAIRU is materially lower, the soft-landing narrative could continue—and we may see several more finely calibrated cuts before year-end.

The Phillips curve cannot fail, it can only be failed!

But doesn't this speak well of the credibility of the inflation targeting regime? A fully credible regime should be one in which the trade-off is pretty flat.