Here is a sneak preview of some work in progress I’m working on looking at how monetary policy in Australia has helped stabilise the economy.

In a nutshell I use the RBA’s model of the economy - nicknamed MARTIN - to estimate what would have happened if the RBA had set a different path for the overnight cash rate at different times in the past 20 years.

I look at three different periods - the 2001 slowdown, the GFC and the 2016-2019 undershooting period and consider two alternative histories

What if the RBA never changed the interest rate at all - they essentially go on holiday and never move the dial.

What if the RBA optimally respond to inflation and the unemployment gap to keep them close to their respective targets (there are two types of this optimal policy approach, but they are very similar).1

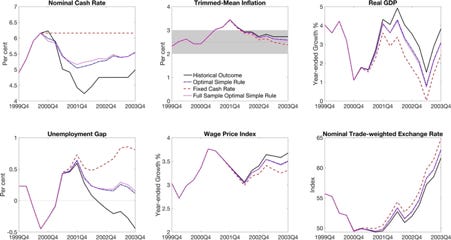

2000-2003 – A Recession Avoided

In the early 2000s several major economies experienced a downturn, with the United States, Germany and Japan falling into recession. Australia avoided a significant downturn. The counterfactual analysis finds that this economic success can be attributed in large part to the RBA’s decision to cut the cash rate.

Compared with the hypothetical in which the cash rate was kept unchanged, we estimate that in the 2000-2003 period (spanning the 2001 downturn), monetary policy saved 1.3 percentage point-years of unemployment, while ‘optimal’ monetary policy following the MARTIN model would have saved only 0.8 percentage point-years of unemployment (0.5 percentage point-years worse than monetary policymakers actually delivered). Since the average size of the labour market in 2001 was 9.7 million, the policymakers’ improved performance over the simple rule translates to nearly 50,000 jobs for a year. MARTIN estimates that actual policy decisions pushed the unemployment rate below the estimated NAIRU with only moderate effects on trimmed-mean inflation.

This historical episode is a prime example of monetary policy being actively used to ward off a recession that hit other advanced economies.

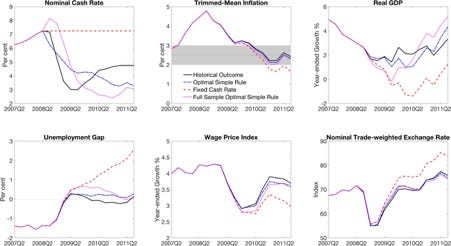

2008-2011 – A Downturn Mitigated

In the Global Financial Crisis, the Australian economy experienced a moderate downturn with the unemployment rate increasing by more than 1 percentage point from peak to trough. This relatively mild outcome was in part the result of aggressive countercyclical policy deployed by both monetary and fiscal authorities.

MARTIN calculates that if the RBA had not reacted at all, and kept the cash rate constant, then the unemployment rate would have risen to over 7 per cent – more than 2 percentage points above the level consistent with full employment. Moreover trimmed-mean inflation would have fallen below the RBA’s target band.

Compared with a hypothetical in which the cash rate was kept unchanged, we estimate that in the 2008-2011 period (spanning the 2008-2009 downturn), monetary policy saved 2.8 percentage point-years of unemployment, while the simple optimal policy rule would have saved only 2.3 percentage point-years of unemployment.

These results suggest that in the past two decades the RBA has mostly fulfilled this mandate. In particular, its easing of monetary policy in response to global downturns was instrumental in avoiding a recession in 2001 and mitigating the impact of the Global Financial Crisis in 2008-2009.

In part II I will unpack the far more interesting and complex results for 2016-2019…

One of the limitations of the optimal simple rule is that they can only respond to changes in inflation and the unemployment rate. They cannot respond to fast moving events such as the collapse of financial markets in 2008 or September 11th in 2001.